By David Ma, Managing Director, Ocean Bright Logistics Limited

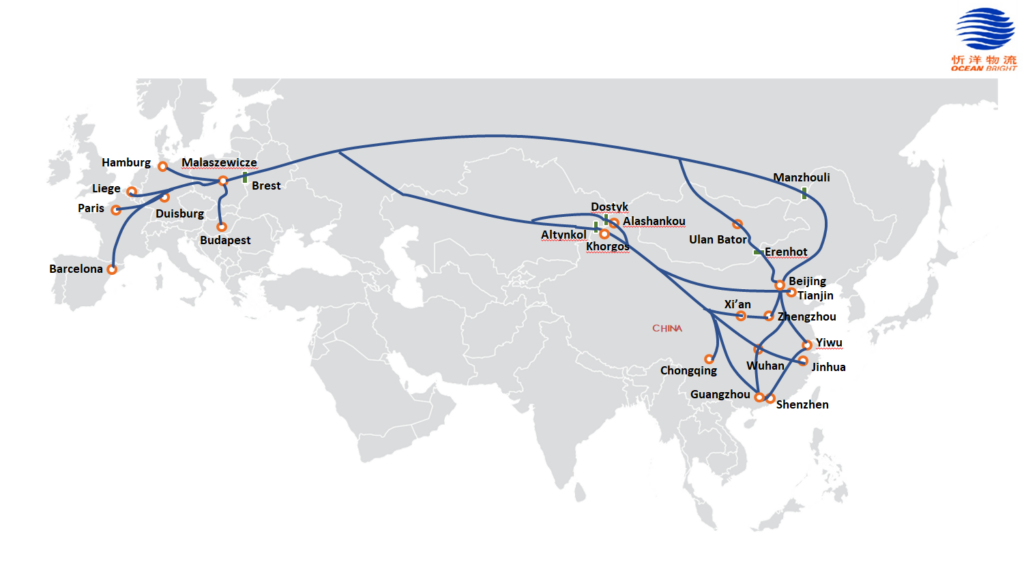

Rail transport plays a crucial role in China's export infrastructure by linking its manufacturing centers with European markets via the China-Europe freight train network. This rail system offers an alternative to sea and air freight, balancing cost efficiency and transit time effectively. Providing reliable and fast transportation, it streamlines the supply chain, reduces shipping costs, and ensures timely delivery. This network not only enhances trade connectivity between China and Europe but also supports China's international commerce growth by offering a sustainable and efficient logistics solution.

Market Analysis and Forecast

In March 2025, demand for freight trains increased after the Spring Festival due to heightened manufacturing and export activities. Rail freight, with transit times of 12-18 days compared to 30-40 days by sea, meets the needs of businesses transporting goods like electronics, machinery, and consumer products.

Freight rates in early 2025 are determined by supply and demand, oil prices, the ongoing Russia-Ukraine conflict, and China-Europe diplomatic relations. Rail operators adjust pricing to ensure stable operations and maintain shipper interest. In 2025, the network is expected to grow, connecting more European cities and improving coverage beyond hubs such as Duisburg, Malaszewicze, and Budapest. Advances in digitization, including cargo tracking and customs systems, are reducing delays. Environmental efforts, such as trials of electric or hybrid locomotives, aim to lower emissions, while coordination with sea and air transport enhances logistics efficiency.

Northern Route and Transshipment at the China-Kazakhstan Border

The northern route is the primary corridor for China-Europe rail freight, connecting cities like Chongqing, Chengdu, Xi’an, and Zhengzhou to European destinations such as Malaszewicze, Budapest, and Duisburg via Russia. It utilizes Russia’s extensive rail infrastructure, making it the most established option.

At the China-Kazakhstan border, primarily Dostyk (Kazakhstan) and Alashankou (China), cargo is transferred due to differing rail gauges—1,435 mm in China and 1,520 mm in Kazakhstan and Russia. As of January 2025, transshipment takes 24-36 hours, depending on cargo volume and customs processes. For instance, a train from Xi’an with 41 containers (about 82 TEUs) typically requires 1-1.5 days at the border.

The route supports significant capacity: Chongqing operates 10-12 weekly trains (500-600 TEUs), and Chengdu handles 8-10 departures (400-500 TEUs). Transit times vary, with Xi’an to Malaszewicze taking 12-14 days and Chongqing to Duisburg averaging 16-18 days, including border delays. Despite Russia’s October 2024 embargo on certain goods, which shifted some traffic, the route remains operational with adjusted schedules.

The Middle Corridor, or Trans-Caspian International Transport Route (TITR), extends from China through Central Asia, across the Caspian Sea, via the South Caucasus and Turkey, to Europe. It has become more prominent in 2025 due to geopolitical issues, including the Russia-Ukraine conflict and Central Asia’s political instability. Countries such as Turkey, Azerbaijan, and Uzbekistan are investing in its infrastructure to strengthen its role in Asia-Europe trade.

Following Russia’s 2024 embargo, container traffic increased through Caspian Sea ports like Aktau (Kazakhstan) and Baku (Azerbaijan). However, capacity issues persist. In March 2025, Aktau reports a backlog of 600-700 containers, with waiting times exceeding 20 days due to limited ferry availability. Transit times are longer than the northern route, with Xi’an to Istanbul taking 20-25 days under normal conditions, though delays at Aktau can extend this beyond a month. Costs are higher, ranging from $5,000-$7,000 per 40-foot container, compared to $4,000-$6,000 on the northern route. Logistics providers recommend avoiding this corridor for time-sensitive shipments, though planned improvements, such as additional ferries and port upgrades, may enhance its performance later in 2025.

Comparative Analysis and Challenges

The northern route offers reliability, higher capacity, and shorter transit times, supported by established infrastructure and stable border operations. Its dependence on Russia, however, introduces risks from sanctions and embargoes. The Middle Corridor avoids Russian territory but faces infrastructure constraints and delays, particularly across the Caspian Sea.

Both routes encounter challenges, including geopolitical tensions from the Russia-Ukraine conflict, fluctuating oil prices, and competition among operators that may reduce rates and margins. Infrastructure limitations, such as single-track sections on Kazakhstan’s Dostyk-Mointy line (under expansion in 2025), restrict capacity. Addressing these requires ongoing investment and cooperation among China, Central Asian countries, and European partners.

China-Europe Rail Transport Outlook for 2025

In 2025, the China-Europe rail transport network is expected to progress steadily and improve its service more as we move into the year. The northern route will remain the primary option, supported by efficient transshipment at the China-Kazakhstan border and high capacity from key stations. Expansion to additional European cities and digital improvements will enhance its operations. The Middle Corridor, despite current limitations, shows potential as an alternative, with investments targeting bottlenecks like Aktau. Environmental initiatives, including new-energy locomotives, and integration with sea and air transport will further support the network.

In summary, rail freight is a key component of China’s export framework, connecting Asia and Europe amid economic and geopolitical shifts and challenges. The northern route, with its reliable transshipment, contrasts with the developing Middle Corridor, which faces capacity challenges in 2025. Together, they demonstrate a network adapting to global trade needs, with growth anticipated alongside persistent obstacles. This will continue to strengthen China's transshipment and logistics mobility.

Freyt World Blog Contributor

Freyt World is a global logistics network uniting members from around the world. Our mission is to revolutionize global logistics through collaboration and innovation. Our platform goes beyond networking, enabling members to excel and grow together, featuring articles by logistics professionals for their peers. This series will cover industry-relevant issues and news, providing valuable insights for professionals in the field.